The insurance industry is evolving rapidly, and conversational AI is playing a pivotal role in this transformation. AI solutions are streamlining operations, reducing costs, and enhancing customer engagement. Teneo’s conversational AI, powered by large language models (LLMs) like OpenAI GPT-4o, Google Gemini and Amazon Bedrock, enables insurers to automate routine tasks, provide multilingual and multimodal support, and ensure over 99% accuracy in customer communications. This efficiency helps insurers stay competitive while ensuring compliance with industry regulations and maintaining top-tier data security.

5 Key Use Cases of Conversational AI Insurance

- 24/7 Customer Support

Conversational AI insurance provides round-the-clock support, offering immediate answers to customer queries, processing claims, and assisting with policy details without the need for human intervention. This leads to increased customer satisfaction and loyalty.

2. Automated Claims Processing

Filing insurance claims is often a cumbersome process, but conversational AI simplifies it by automating the collection and verification of data. With LLM orchestrator platforms like Teneo, virtual assistants guide customers through each step, reducing friction and expediting claims management, resulting in faster resolutions.

3. Fraud Detection and Prevention

AI-powered systems are capable of analyzing large amounts of data in real time. Conversational AI tools, like those provided by Teneo combined with Teneo Generative AI, can detect unusual patterns during customer interactions, flagging potentially fraudulent claims early and protecting insurers from significant financial losses.

4. Policy Customization and Personalization

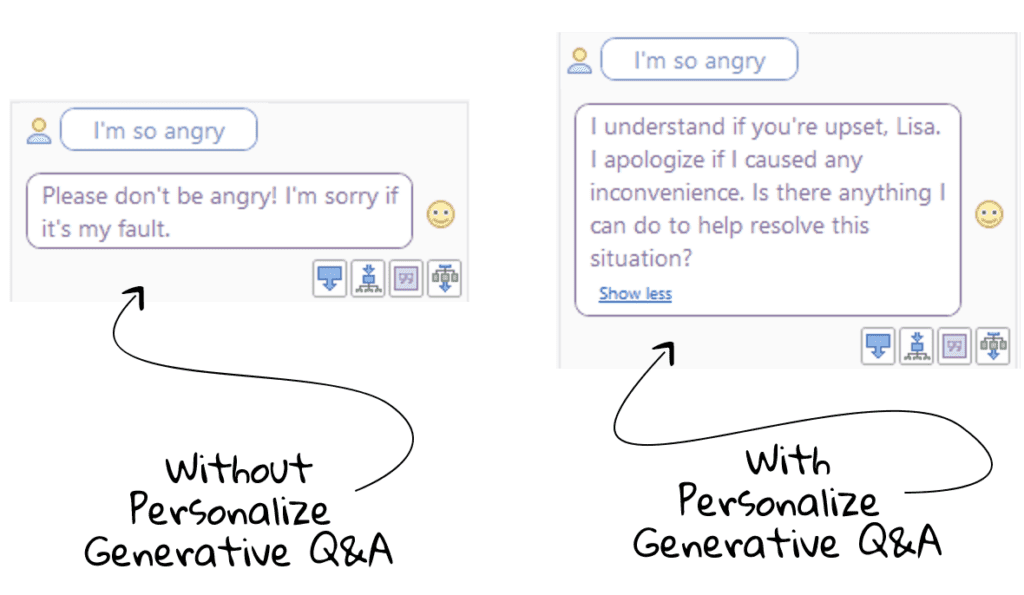

With conversational AI, insurers can provide tailored policy recommendations based on customer behavior and preferences. Teneo’s solution offers personalized service with Teneo Adaptive Answers, helping customers understand and choose coverage that fits their unique needs, boosting engagement and retention.

5. Cost Reduction and Operational Efficiency

Teneo’s conversational AI allows insurance companies to reduce operational expenses by automating repetitive tasks. It frees up customer service agents to focus on more complex issues, driving greater efficiency. Insurers can have up to a 98% reduction in LLM costs with the FrugalGPT approach, highlighting the transformative potential of conversational AI.

Benefits of Conversational AI Insurance

- Multilingual Support: Insurers can provide consistent service across languages, ensuring a broader reach and improved customer satisfaction.

- Data Security and Compliance: Conversational AI solutions like Teneo offer robust data protection, ensuring adherence to industry regulations.

- Scalability: As customer demands grow, AI solutions allow insurers to easily scale without compromising on service quality.

The Future of Conversational AI Insurance

Conversational AI’s role in the insurance industry will continue to expand as technologies like Teneo evolve. Future advancements will likely include deeper integration with predictive analytics, enabling different industries to proactively offer solutions to customers based on data insights. Additionally, voice-activated systems will become more prevalent, allowing for even more seamless interactions.

Ready to transform your insurance services with conversational AI? Contact us to learn how Teneo’s AI-powered solutions can help your business streamline operations, enhance customer engagement, and reduce costs.

FAQ

What is conversational AI in insurance?

Conversational AI in insurance refers to AI-driven tools that engage with customers in natural language, helping with policy selection, claims processing, and more.

How does Teneo’s conversational AI improve customer interactions?

Teneo’s platform delivers 99% accuracy, offering personalized, multilingual support across channels, which enhances customer satisfaction.

How does conversational AI reduce costs for insurers?

Conversational AI automates routine tasks, reducing the need for human agents, and can cut operational costs by up to 98%.

Is conversational AI secure for any industry?

Yes, platforms like Teneo provide robust data security and compliance with industry regulations, ensuring customer data is protected.

What future trends are expected for conversational AI?

Expect deeper integration with predictive analytics, voice-activated systems, and more personalized, proactive service offerings.