The banking industry is embracing a significant transformation, driven by the integration of advanced AI solutions like Teneo. This shift is redefining how banks operate, enhancing customer experiences, streamlining processes, and boosting overall efficiency. Teneo is leading this revolution, offering innovative solutions to meet the evolving needs of the banking sector.

The Impact of AI on Modern Banking

Personalized Banking Services

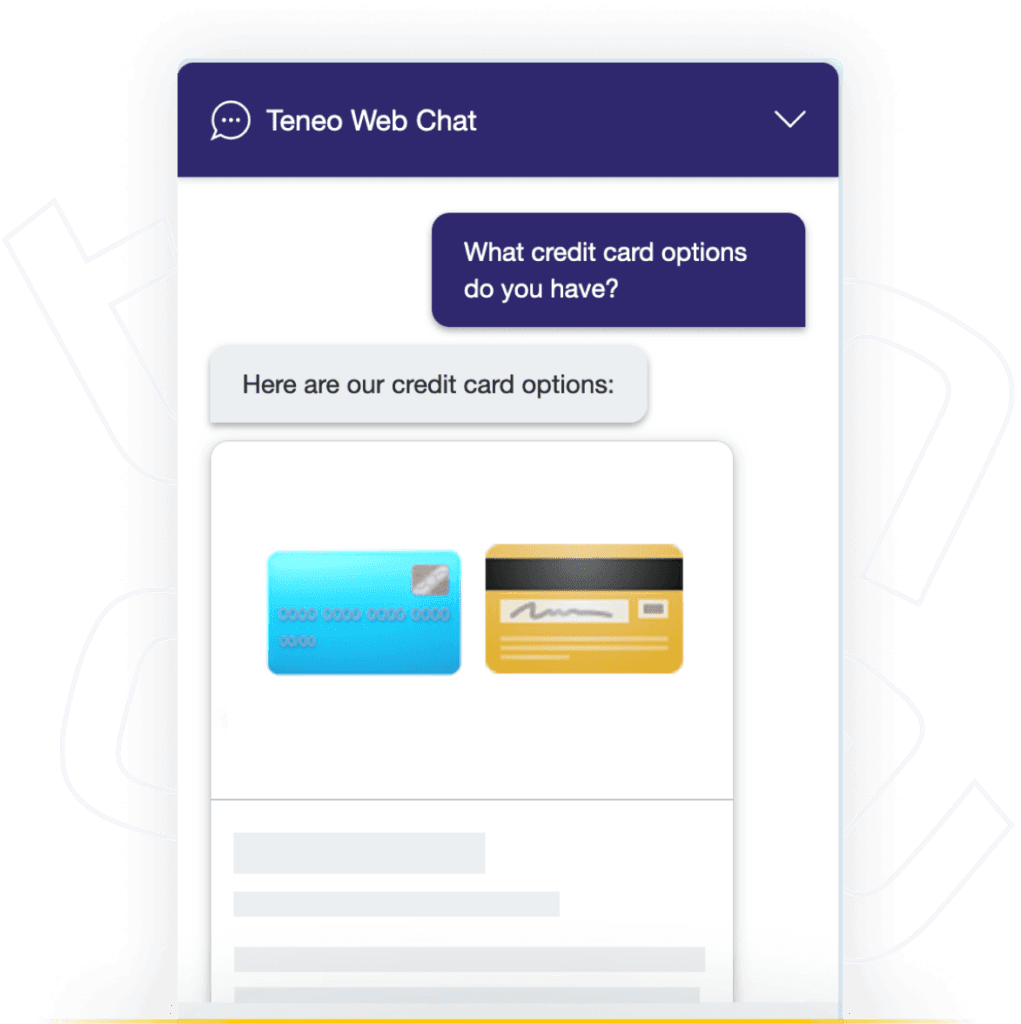

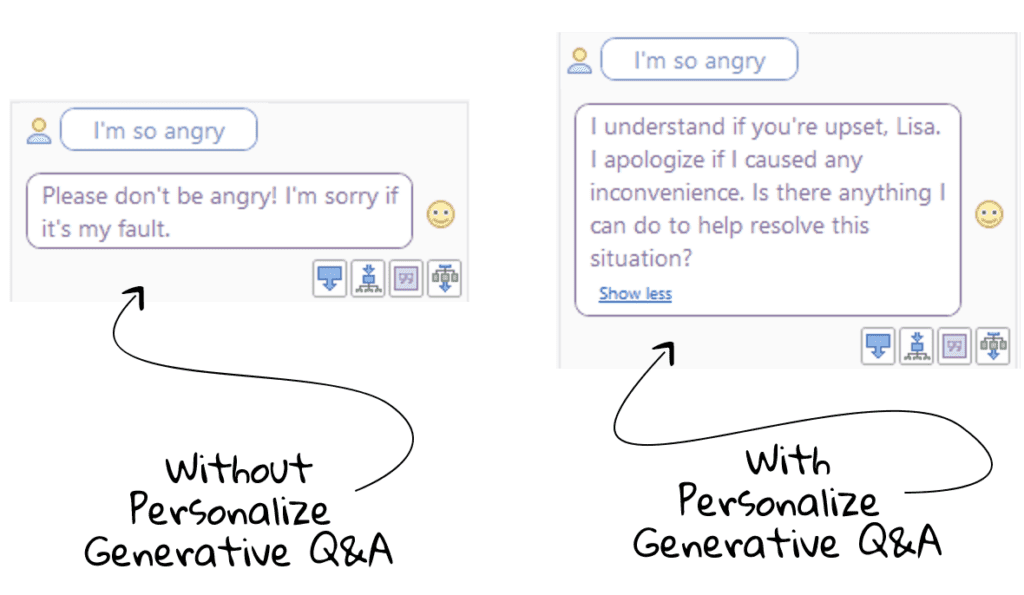

Teneo leverages AI to provide highly personalized banking experiences. By analyzing customer data and behavior, Teneo can offer tailored financial advice, personalized product recommendations, and customized services, making each interaction unique and relevant.

Improved Customer Support

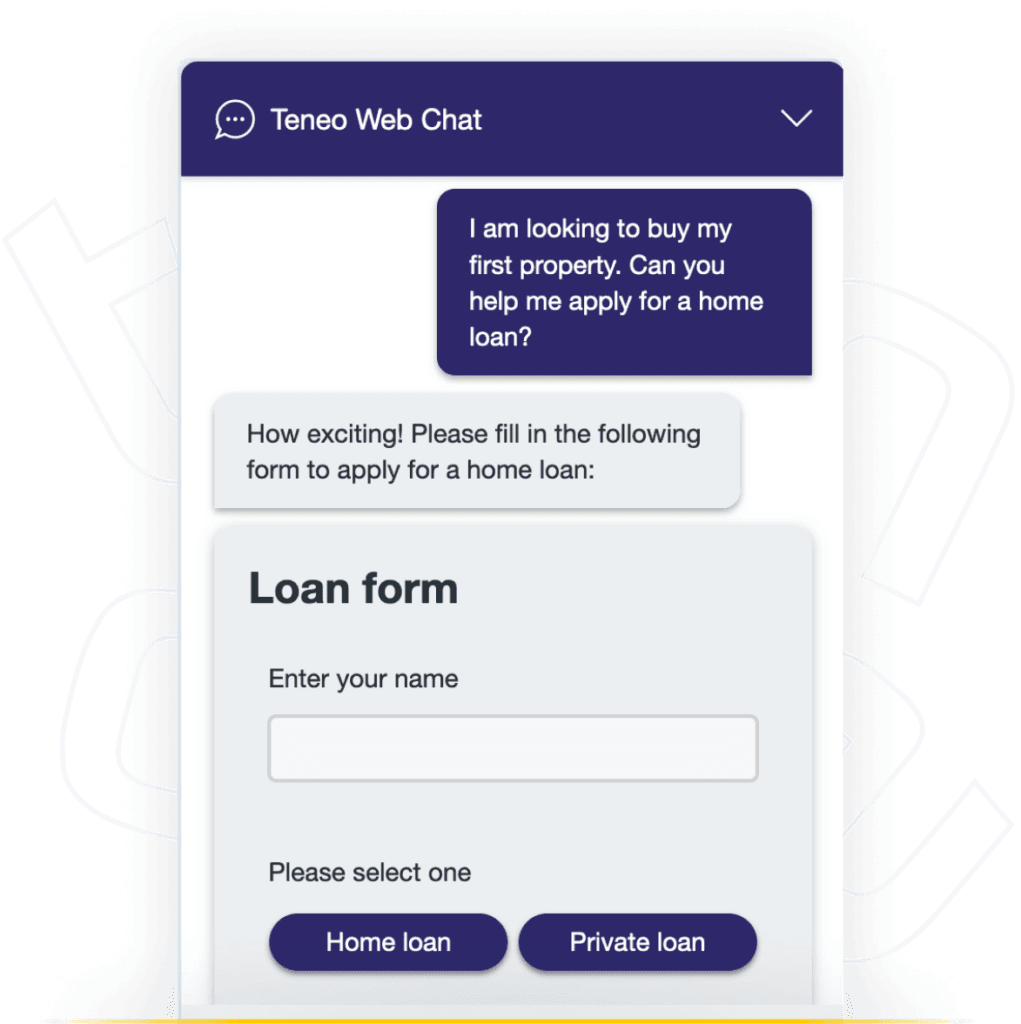

With Teneo, banks can revolutionize their customer support. Virtual assistants powered by Teneo can handle a variety of tasks, from answering account inquiries and assisting with transactions to providing financial planning tips and managing loan applications. This ensures customers receive prompt and efficient service 24/7.

Operational Efficiency

Teneo solutions streamline banking operations by automating routine tasks and optimizing resource allocation. From processing transactions and managing compliance checks to handling customer queries and fraud detection, AI helps reduce operational costs and improve overall efficiency, allowing bank staff to focus on delivering exceptional customer service.

Key Benefits of Teneo AI in Banking

Enhanced Customer Satisfaction

Teneo elevates customer satisfaction by delivering personalized and responsive services. Customers enjoy a seamless banking experience, from account management to financial planning, with every interaction tailored to meet their specific needs and preferences.

Increased Revenue

Personalized product recommendations and targeted marketing campaigns powered by Teneo can drive revenue growth. By understanding customer preferences and financial behavior, banks can upsell services, suggest relevant products, and offer special promotions that resonate with their customers.

Actionable Insights

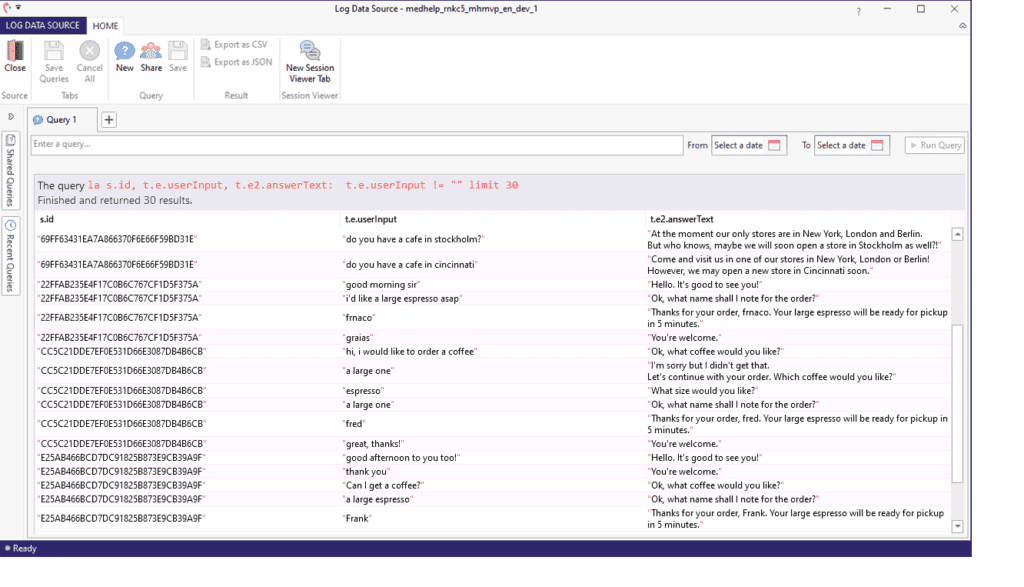

Teneo provides valuable insights into banking operations and customer data. By analyzing data from multiple sources, the platform identifies trends and areas for improvement, enabling banks to make informed decisions and continuously enhance their services. These logs can be used to deliver reports in PowerBI for example.

Real-Time Problem Solving

AI-driven systems can quickly identify and address issues before they impact customers. Whether it’s a security threat or a service disruption, Teneo ensures that potential problems are handled promptly, maintaining a high level of customer trust and satisfaction.

Future Outlook with Teneo AI

The future of banking is increasingly intertwined with advanced AI technologies. Teneo represents a significant advancement, offering tools that enhance customer service, streamline operations, and drive financial innovation. As AI continues to evolve, the banking sector can look forward to even more groundbreaking solutions that will redefine financial services.